ny paid family leave taxable

Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program. This amount is subject to contributions up to the annual wage base.

The Next Big Question On New York Paid Family Leave How Do We Determine Tax Obligations

Family Leave Insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes.

. However an employee can request to have income taxes withheld by filing Form W-4V. As PFL premiums are funded through employee payroll deductions the Department has reviewed the tax treatment of these contributions. New York designed Paid Family Leave to be easy for employers to implement with three key tasks.

New York States Department of Taxation and Finance released guidance regarding the tax implications of New York Paid Family Leave PFL the benefits of which take effect on January 1 2018. Employers may collect the cost of Paid Family Leave through payroll deductions. OMB Waiver of Paid Family and Paid Sick Leave.

This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction. Paid Family Leave Benefits available to employees as of. The New York State Department of Taxation and Finance Department recently released its guidance on the tax implications of the New York Paid Family Leave Benefits PLF law for New York employees employers and insurance carriers.

Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay period with a maximum annual contribution of 42371. Benefits paid to employees will be taxable non-wage income that should be included in federal gross income. N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages.

Employee-paid premiums should be deducted post-tax not pre-tax. The maximum annual contribution for 2022 is 42371. NYSIF must provide insurance to any employer seeking coverage regardless of the employers.

In New Jersey go to Other Non-Wage IncomeYou will see a Description and Amount from your employers 1099-MISC. Aug 31 2017. Here are the key points.

Paid Family Leave provides eligible employees job-protected paid time off to. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. Employees earning less than the Statewide Average Weekly Wage SAWW.

My income from New York State Paid Family Leave was sent as a 1099-MISC. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. NYSIF is a not-for-profit agency of the State of New York that offers workers compensation New York State disability benefits and Paid Family Leave insurance.

When I enter it it doesnt give me the option to say it was paid leave and moves the income into the self-employment business section. 1 However basic questions regarding the tax treatment of both deductions from employee wages to finance benefits although employers have been permitted to take such deductions since July 1 2017 and the. New York Paid Family Leave is not optional for most employees.

Reportable as income for IRS and NYS tax purposes. Effective January 1 2018 PFL will provide eligible employees with up to 8 weeks of pay for a leave. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

It is a separate and distinct entity from the New York State Workers Compensation Board. Estate taxes can take a big bite out of your familys wealth. The weekly PFL benefit is capped at 67 of the New York State.

In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 145017. On August 25 2017 the New York State Department of Taxation and Finance DFS released highly anticipated guidance regarding taxation of PFL benefits and premium in Notice N-17-12. Employees can request voluntary tax.

The maximum weekly benefit for 2021 is 97161. Taxes will not automatically be withheld from benefits. 2 Collect employee contributions to pay for their coverage.

The New York Workers Compensation Board issued final regulations interpreting the New York Paid Family Leave Law on July 19 2017. The exception is if they are in a job that will not allow them to attain. Paid Family Leave PFL is now available to eligible employees of the City of New York.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534.

The Paid Family Leave wage replacement benefit is also increasing. Pursuant to the Department of Tax Notice No. Paid Family Leave may also be available.

3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. 5 days annual paid personal leave. The contribution remains at just over half of one percent of an employees gross wages each pay period.

1 Obtain Paid Family Leave coverage. New York paid family leave benefits are taxable contributions must be made on after-tax basis. Paid Family Leave deductions and benefits are based on the New York Statewide Average Weekly Wage SAWW.

Im not sure how to change this as it is not a schedule c. The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee wages used to finance paid family leave premiums and the tax treatment of paid family leave benefits to be received by eligible employees. Employees earning less than the current Statewide Average Weekly Wage SAWW of.

In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Enter another line Non-taxable NY Paid Family Leave in the description and the same amount as a NEGATIVE. The maximum annual contribution is 42371.

If an employer chooses to hire a temporary employee to replace a. Benefits paid to employees will be taxable non-wage income that must be included in federal gross income. Requirements for other types of employers are.

After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

Cost And Deductions Paid Family Leave

Paid Family Leave For Family Care Paid Family Leave

New York Paid Family Leave Ny Pfl The Hartford

Get Ready For New York Paid Family Leave In 2021 Sequoia

New York Paid Family Leave 2022 Contributions And Benefits Schulman Insurance

Paid Family Leave Expands In New York The Cpa Journal

New York Paid Family Leave 2022 Contributions And Benefits Schulman Insurance

New York Paid Family Leave 2022 Contributions And Benefits Schulman Insurance

New York Paid Family Leave Resource Guide

New York Paid Family Leave 2022 Contributions And Benefits Schulman Insurance

Paid Family Leave For Family Care Paid Family Leave

New York Paid Family Leave Updates For 2022 Paid Family Leave

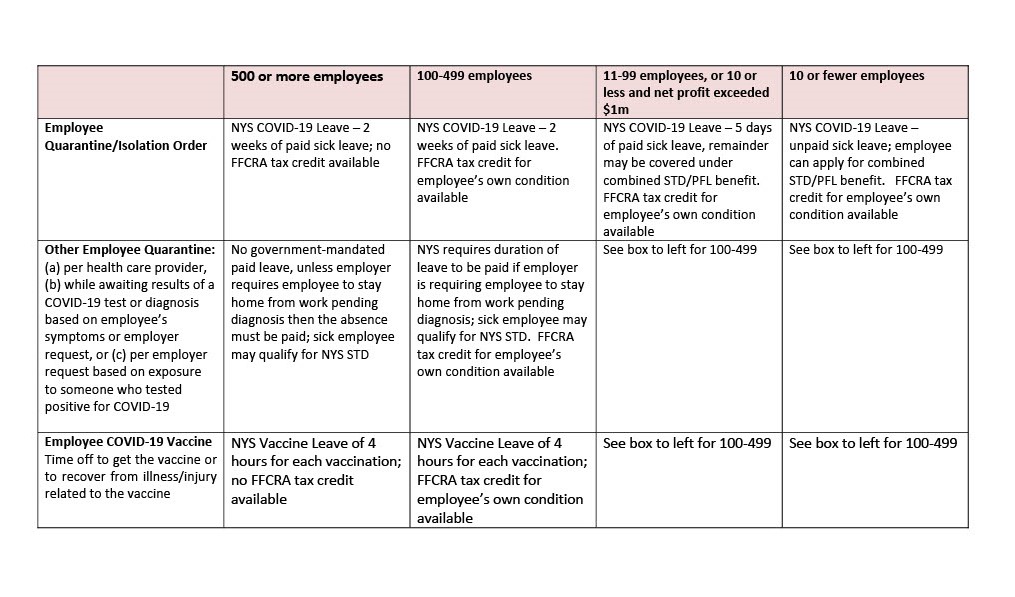

Reconciling 2021 S Expanded Nys And Ffcra Covid Related Leave Obligations Levy Employment Law

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released