japan corporate tax rate history

Since then the rate peaked at 528 in. 5 rows 73 51 73 53 Over JPY 8 million.

Chart Uk Tax Burden To Hit Highest Level Since The 60s Statista

The penalty is imposed at 5 to 10 once the tax audit notice is received.

. The federal corporate income tax was fist implemented in 1909 when the uniform rate was 1 for all business income above 5000. The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the standard regular business tax rate. Required to pay at a higher tax rate 1932-1933 1942-1963 and allowed the option without penalty 1922-1931 1964 to the present.

However relatively high marginal and average effective tax rates prompt the. Tax rates for companies with stated capital of more than JPY 100 million are as follows. Indirect tax rates individual income tax.

Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. Sales Tax Rate 000. Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018.

Size-based business tax consists of two components. National Income Tax Rates. Corporate Tax Rate 2100.

Japan Corporate tax. Over the past 40 years corporate tax rates have consistently declined on a global basis. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

Taxable income 4 mln 8 mln 4 mln 8 mln. 1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese. The Reduction of Statutory Corporate Tax Rates.

Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen. Outline of the Reduced Tax Rate System for Consumption Tax. The effective Japanese corporate.

Since then the rate peaked at 528 in 1969. In addition interest for the late payment of tax is levied at 26 per annum for the first two. 1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on.

Understand Japanese corporate income tax consumption sales tax VAT and withholding taxes for Japanese companies and branch-offices in Japan. Personal Income Tax Rate 3700. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes.

96 67 96 70 Local corporate special tax. 6 rows Corporate Tax Rate. OECD Corporate Income Tax Rates Australia Austria Belgium Canada Chile.

Dec 2014 Japan Corporate tax rate. In 1980 the unweighted average worldwide statutory tax rate was 4011 percent. Items Covered by the Reduced Tax Rate System Information on.

An update to this dataset has been posted to the Tax Foundation Github data archive. Statutory Corporate Income Tax Rate in Japan as of April 2014 1. Historical corporate tax rate data.

Table 1 below gives a history of corporate tax rates. The structure of Japans corporate income tax system is broadly in line with those of other G7 countries. Social Security Rate 1530.

Data is also available for.

Toward Meaningful Tax Reform In Japan Cato Institute

What Would The Tax Rate Be Under A Vat Tax Policy Center

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

9 Things You Should Know About The Tax Debate Itep

Malta Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

Corporate Tax Reform In The Wake Of The Pandemic Itep

Toward Meaningful Tax Reform In Japan Cato Institute

Real Estate Related Taxes And Fees In Japan

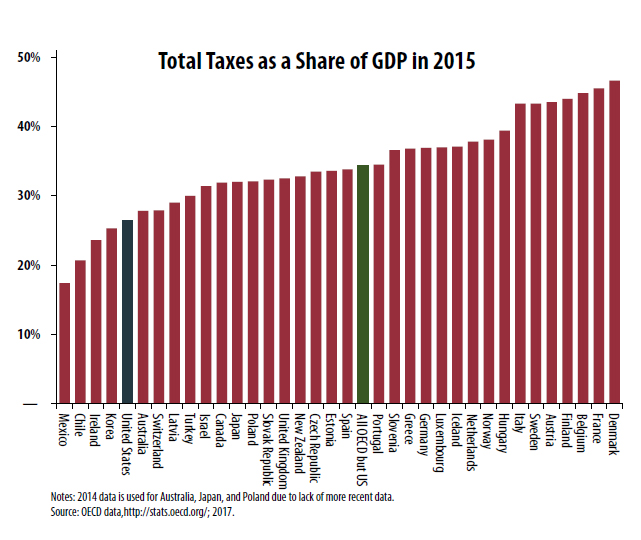

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporate Income Tax Definition Taxedu Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Corporate Tax Reform In The Wake Of The Pandemic Itep

The History Of Taxes Here S How High Today S Rates Really Are

Real Estate Related Taxes And Fees In Japan

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

How Do Taxes Affect Income Inequality Tax Policy Center

Real Estate Related Taxes And Fees In Japan